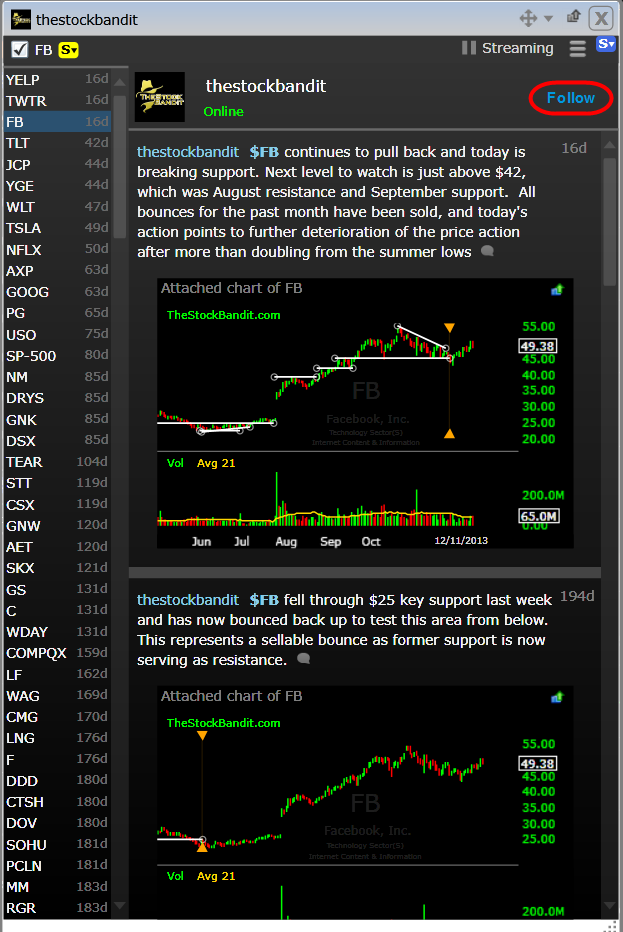

Some traders spend every day on Twitter, posting dozens of trades and conversing nonstop. It can be a lot to keep up with!

I try not to clutter the feed with non-pertinent info, unless it’s the evening or weekend when I might do a little more. Regarding my market thoughts, however, I’ve put out some useful ideas recently which you stood to benefit from if you’re following.

For example, on May 22nd at 10:01AM, I posted the following:

That proved to be timely, as it’s currently standing as the market top.

This week, I shared some additional thoughts on the eve of the FOMC announcement.

Note that I didn’t predict anything, as that’s just not my style. But I did point out the possibility for a downside reversal post-FOMC, as well as provide some reasons behind it.

Remaining a student of the recent price action will keep you on track. If you’re listening to other opinions, be sure they’re objective and not of the crystal-ball variety.

Trade Like a Bandit!

Jeff White

Take a trial to the Stock Pick Service to get my trades.

During a recent conversation with a trader, I was asked how I handle the pressure of making a living trading when I have not just the standard monthly expenses but a family as well. As I relayed my answer and spoke honestly about what it was, it hit me that I needed to share this with you, because for whatever reason I just don’t think I’ve done so before.

During a recent conversation with a trader, I was asked how I handle the pressure of making a living trading when I have not just the standard monthly expenses but a family as well. As I relayed my answer and spoke honestly about what it was, it hit me that I needed to share this with you, because for whatever reason I just don’t think I’ve done so before. On Sunday evening, I was reminded of a dream I used to feed.

On Sunday evening, I was reminded of a dream I used to feed. As a kid, I’d get on any ride. No roller coaster intimidated me, I was game for anything. But then something happened, and I’m not sure what it was. Some kind of mental obstacle just appeared, and I’m not sure why. All I know is that in recent years, I backed away from the big rides. I got on some of them, but I didn’t like them! Why?

As a kid, I’d get on any ride. No roller coaster intimidated me, I was game for anything. But then something happened, and I’m not sure what it was. Some kind of mental obstacle just appeared, and I’m not sure why. All I know is that in recent years, I backed away from the big rides. I got on some of them, but I didn’t like them! Why?